Why is crypto crashing?

Two words

“The Fed”. Or maybe “Do Kwan”. Either way Bitcoin and the entire crypto market got rekt last week and are down again over the last 24 hours.

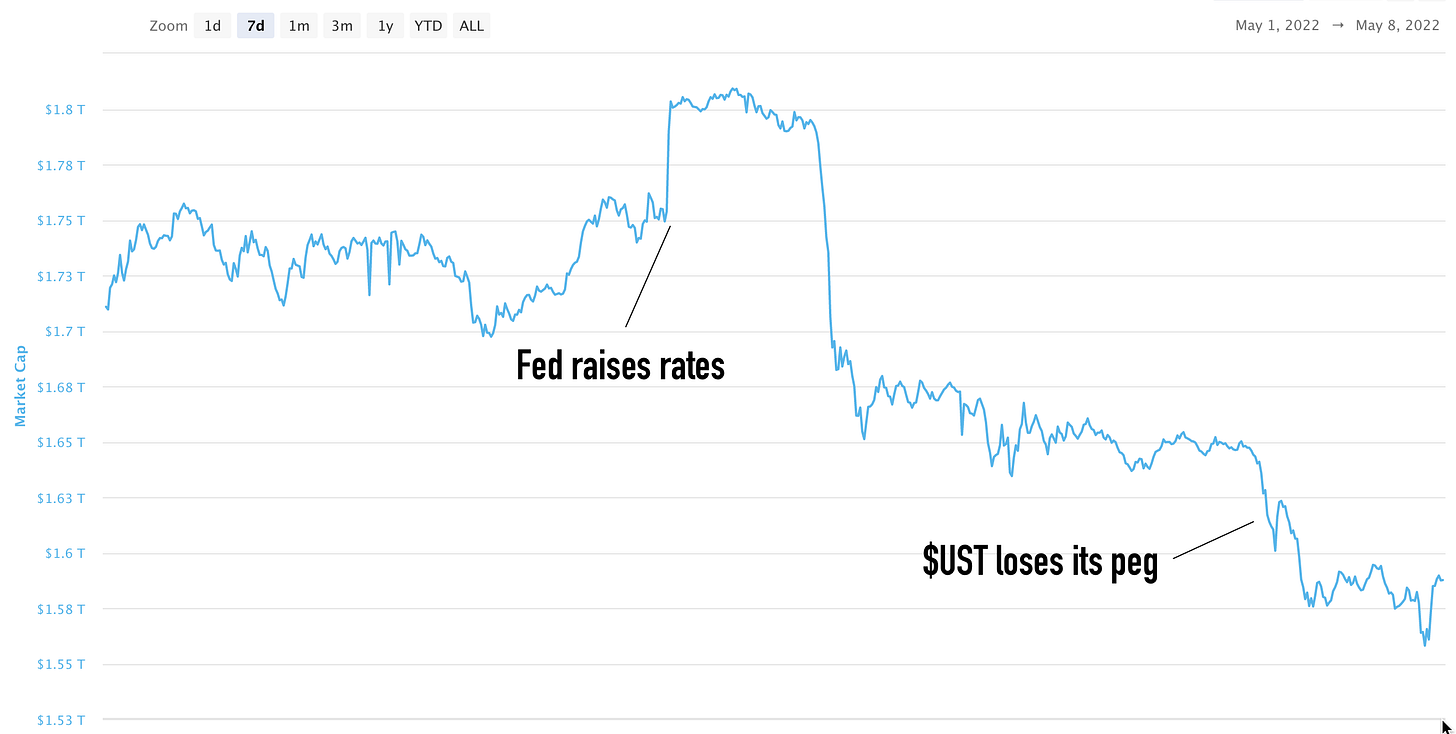

Total crypto market cap is down $110B over the last 7 days. The biggest decline was a one-day delayed reaction to the Fed meeting last week in which they decided to raise rates 0.50% and pledged to continue raising rates by 50 basis points for at least the next two meetings. Initially stocks and crypto spiked because Jerome Powell took future 75bp moves off the table, but after digesting the news overnight traders decided the Fed is still serious about fighting inflation, which is bad for risk assets. Besides, the Fed wants the stock market to go down.

The Fed thinks that by bringing down the price of risk assets, it can control inflation without having too much effect on the job market. The is because of the so-called “wealth effect”, which makes people spend less money when they feel less wealthy (like when their 401k goes down). That means that if the stock market starts going up more than the Fed wants, somebody is going to make another hawkish statement to send stocks lower. And even though people will argue that Bitcoin shouldn’t be a correlated asset, the BTC chart has been tracking the Nasdaq chart pretty closely. That means that until the Fed changes course, we are going to remain in a difficult environment for stocks and crypto.

LUNA & UST

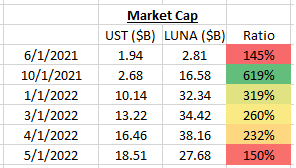

The bad news hitting crypto over the last 24 hours has to do with an algorithmic stablecoin called TerraUSD (UST), which on Saturday began to lose its peg to the dollar and is still fighting to get it back.

This caused a selloff in UST’s sister cryptocurrency LUNA, which was off over 10%, and a broader selloff in the crypto market. Coindesk explains what happened like this:

The de-pegging appeared to kick off with a series of major withdrawals from Anchor Protocol, a lending market that offers high yields to users who deposit UST. Over the weekend, Anchor’s total UST deposits fell from $14 billion down to $11.2 billion (UST’s total circulating supply is $18 billion).

Large quantities of UST were also withdrawn from liquidity pools on Curve, a decentralized finance (DeFi) protocol that allows users to swap between stable currencies like UST. A $150 million liquidity withdrawal came from Terra creators Terraform Labs (TFL). TFL claimed Sunday they made the withdrawal as they were preparing to shuffle around funds between pools, but they re-deposited $100 million after realizing UST had begun to trade a discount relative to other stablecoins.

Adding a tinge of conspiracy to yesterday’s events, a single wallet also raised eyebrows for dumping $84 million worth of UST on Ethereum and $108 million on Binance. This has led to calls from within the Terra community that the depeg was a “coordinated attack.”

To make things more complicated, UST is partially backed by Bitcoin reserves now and traders are worried that if UST loses its peg and LUNA goes down too far in value, Do Kwan, the founder of Terraform Labs, will have to sell his billions of dollars in BTC to fight for the UST peg.

If this happens, investors are concerned that the price of Bitcoin could be headed even lower, perhaps in a “capitulation” event. If that’s too much FUD for you, don’t worry, Do Kwan says everything is going to be ok.

In summary, we have a potentially rocky road ahead of us until something breaks and the Fed backs off its tightening plans. However, when the Fed does decide to reverse course - and they always have in the past - then watch out because it could send crypto to the moon.

If you ever need help with anything related to cryptocurrency, I offer consulting services for less than half the price of anybody else out there because I don’t pay for advertising and I don’t have a fancy website. You can book with me using my calendar at bitcoinmissionary.com and if you become a yearly paid subscriber to this blog then you can book an hour session for free!